All Categories

Featured

Table of Contents

Acting rapidly may be in your ideal passion. Additionally, one of the most generous policies (sometimes called "guaranteed concern") may not pay a survivor benefit if you die of certain illnesses throughout the initial two years of coverage. That's to stop people from purchasing insurance right away after finding an incurable illness. This coverage could still cover death from crashes and other causes, so study the alternatives readily available to you.

When you aid relieve the economic concern, family and pals can concentrate on taking care of themselves and organizing a purposeful memorial rather of rushing to find money. With this sort of insurance, your beneficiaries may not owe tax obligations on the fatality benefit, and the cash can go towards whatever they require the majority of.

Funeral Policy For Over 75

for changed whole life insurance policy Please wait while we recover information for you. To discover the products that are available please telephone call 1-800-589-0929. Change Place

When you market final cost insurance coverage, you can supply your clients with the peace of mind that comes with knowing they and their family members are prepared for the future. All set to discover everything you require to understand to start offering final expense insurance effectively?

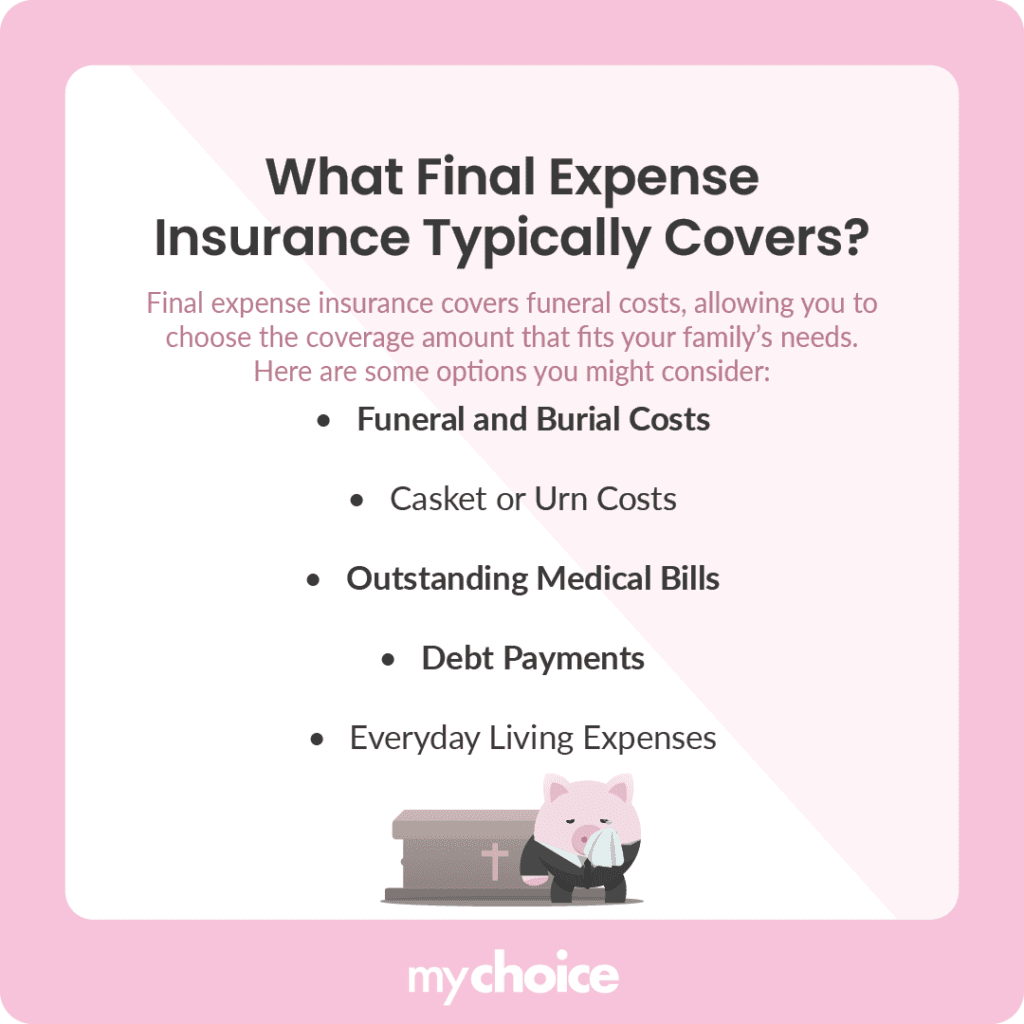

As opposed to offering earnings substitute for loved ones (like the majority of life insurance policy plans do), last expense insurance policy is indicated to cover the prices linked with the insurance policy holder's watching, funeral service, and cremation or burial. Legally, however, beneficiaries can typically utilize the policy's payout to pay for anything they wish. Usually, this kind of plan is provided to people ages 50 to 85, yet it can be issued to more youthful or older individuals.

There are 4 main kinds of final expense insurance coverage: guaranteed concern, graded, modified, and level (preferred or basic ranking). We'll go much more into detail concerning each of these product types, but you can get a quick understanding of the differences in between them via the table below. Precise benefits and payment schedules may differ depending upon the provider, plan, and state.

What Is Final Expense Life Insurance

You're guaranteed insurance coverage however at the greatest rate. Commonly, ensured issue final expenditure plans are issued to clients with serious or numerous wellness issues that would avoid them from safeguarding insurance policy at a typical or rated score. burial insurance in ohio. These health problems may consist of (yet aren't restricted to) renal illness, HIV/AIDS, body organ transplant, energetic cancer cells therapies, and health problems that limit life span

Furthermore, customers for this kind of plan can have severe lawful or criminal backgrounds. It is necessary to keep in mind that different service providers provide a variety of problem ages on their assured problem policies as low as age 40 or as high as age 80. Some will certainly additionally offer higher face values, approximately $40,000, and others will permit for much better death advantage problems by improving the rates of interest with the return of costs or lessening the number of years until a complete fatality benefit is readily available.

If non-accidental fatality takes place in year two, the carrier might only pay 70 percent of the death advantage. For a non-accidental fatality in year three or later on, the provider would possibly pay 100 percent of the death benefit. Modified last expenditure policies, comparable to graded strategies, consider health conditions that would position your customer in a much more limiting changed strategy.

Some products have particular health and wellness concerns that will certainly obtain favoritism from the provider. There are service providers that will certainly provide plans to younger grownups in their 20s or 30s who might have persistent conditions like diabetic issues. Generally, level-benefit conventional last expenditure or streamlined concern entire life plans have the cheapest premiums and the largest availability of additional cyclists that customers can include in plans.

Aarp Final Expense Life Insurance

Depending on the insurance carrier, both a recommended rate class and standard rate class may be offered - burial insurance with no waiting period. A customer in superb health and wellness without any existing prescription drugs or health and wellness problems might receive a preferred price class with the most affordable premiums possible. A customer in great wellness despite having a few upkeep medications, however no considerable health issues might get typical prices

Similar to other life insurance policy plans, if your clients smoke, use various other types of cigarette or nicotine, have pre-existing health conditions, or are male, they'll likely have to pay a greater price for a final expense plan. Moreover, the older your client is, the greater their price for a strategy will be, given that insurance policy companies think they're taking on more danger when they use to insure older customers.

Final Burial Insurance

That's due to the fact that last expense strategies have level (or "fixed") premiums. The policy will likewise stay in force as long as the insurance holder pays their premium(s). While numerous other life insurance policy policies might require medical examinations, parameds, and participating in doctor declarations (APSs), final expense insurance coverage do not. That's one of the great things regarding final cost strategies.

To put it simply, there's little to no underwriting called for! That being said, there are 2 main kinds of underwriting for last cost strategies: streamlined problem and guaranteed problem (budget funeral cover). With simplified concern plans, customers generally just have to address a couple of medical-related inquiries and may be rejected protection by the carrier based upon those solutions

What Is Final Expense Insurance Policy

For one, this can enable agents to find out what type of strategy underwriting would certainly work best for a particular client. And 2, it aids agents narrow down their customer's alternatives. Some providers may disqualify customers for insurance coverage based on what medications they're taking and for how long or why they have actually been taking them (i.e., maintenance or therapy).

A final expense life insurance policy is a type of long-term life insurance coverage plan. While this plan is created to aid your beneficiary pay for end-of-life costs, they are cost-free to make use of the fatality advantage for anything they need.

Just like any other permanent life plan, you'll pay a normal costs for a last cost plan in exchange for an agreed-upon fatality benefit at the end of your life. Each carrier has various policies and choices, yet it's reasonably easy to manage as your recipients will have a clear understanding of just how to invest the cash.

You might not require this kind of life insurance. If you have long-term life insurance policy in position your last costs might already be covered. And, if you have a term life plan, you might have the ability to transform it to an irreversible policy without some of the additional actions of getting last expenditure insurance coverage.

Final Expense Advertising

Developed to cover limited insurance needs, this kind of insurance policy can be a budget-friendly alternative for people that merely desire to cover funeral expenses. (UL) insurance continues to be in place for your whole life, so long as you pay your costs.

This choice to final expenditure insurance coverage gives options for additional family protection when you require it and a smaller protection amount when you're older.

5 Crucial truths to remember Planning for end of life is never ever pleasant (best funeral insurance for seniors). But neither is the thought of leaving enjoyed ones with unexpected expenditures or debts after you're gone. In several cases, these financial commitments can hold up the settling of your estate. Think about these 5 facts about final expenditures and just how life insurance policy can help spend for them.

Table of Contents

Latest Posts

Affordable Final Expense Insurance

Lead Bank Final Expense

Burial Insurance Nj

More

Latest Posts

Affordable Final Expense Insurance

Lead Bank Final Expense

Burial Insurance Nj